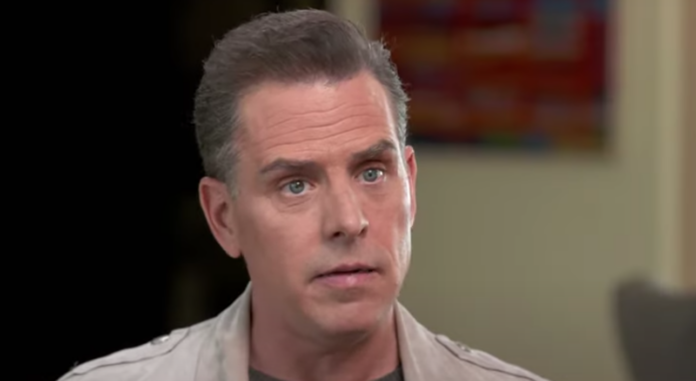

Attorneys for Hunter Biden filed motions to dismiss federal tax evasion charges against him, arguing they violate a previous diversion agreement and constitute “selective and vindictive prosecution.”

Biden pleaded not guilty in January to failing to file/pay taxes from 2013-2018, earning over $7 million but deducting personal expenses.

His lawyers say inflammatory language in the indictment about his lifestyle should be redacted as irrelevant.

The attorneys for Hunter Biden wrote, “This case follows a nearly six-year record of [the Justice Department] changing its charging decisions and upping the ante on Mr. Biden in direct response to political pressure and its own self-interests.”

They also claim the special counsel appointment was unlawful due to lack of congressional approval.

The six-year investigation began under Trump and continued under Biden.

IRS whistleblowers allege the case was intentionally slowed and Biden received preferential treatment.

Biden’s team asserts the whistleblowers engaged in a public campaign to force charges.

Whistleblower Gary Shapley said, “There were really earth-shaking statements made by David Weiss.”

“And the first one was that he is not the deciding person on whether or not charges are filed,” he explained.

“It was just shocking to me,” he admitted.

Hunter Biden is scheduled to testify before House committees next week as Republicans continue their impeachment inquiry against President Biden, though no wrongdoing by the president has been evidenced.

The White House calls the impeachment effort a “baseless political stunt.”

Most Popular:

FBI Informant Who Criticized Biden Gets Bad News

Drag Queen Principal Learns His Fate Amid Controversy